大阪大学 社会経済研究所

Institute of Social Economic Research

Tiffany Tsz Kwan Tse 謝 梓君

復旦大学経済学部卒、Ph.D., 博士 (経済学)(京都大学)

[専門分野]

実験経済学、行動経済学

- Cognitive ability and cooperation in infinitely repeated public goods games

- Strategy analysis on transboundary cooperative behavior in infinitely repeated public goods game

- Making Better Decision: Human Forecaster vs. Algorithmic Forecaster

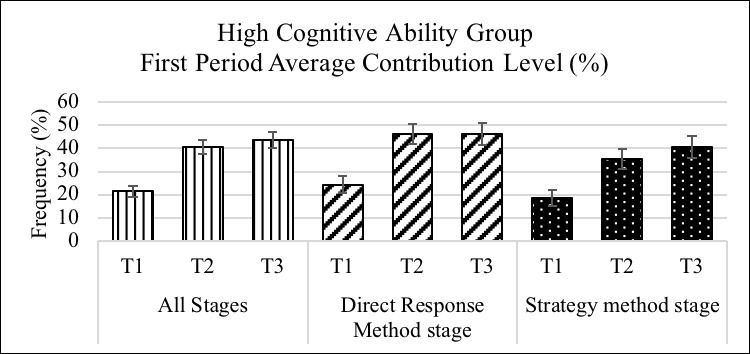

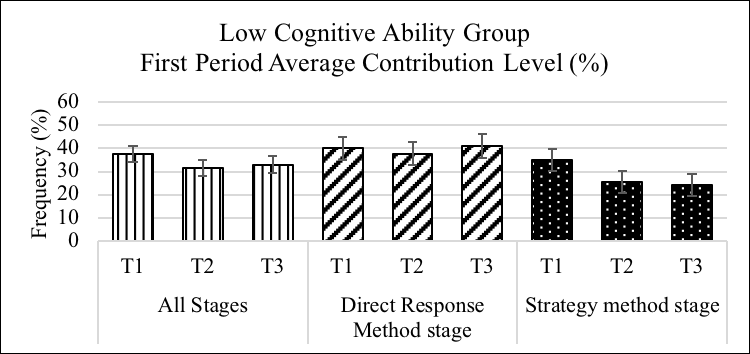

My research studies behavioral and experimental economics, with a focus on cognitive ability and cooperation in infinitely repeated games. Carbon emission reduction is global public goods whose benefits cannot be restricted and does not reduce its availability for others. When individuals contribute to global public goods, they often simultaneously contribute to local public goods which are private to the individuals. For example, they reduce air pollutants in the local area by switching to renewable energy option and reducing energy use. Public goods are impure in reality. What is the effect of local benefits on the contribution to carbon emission reduction? To answer this question, we conduct two games: infinitely repeated public goods (PG) game and infinitely repeated transboundary public goods (TPG) game. In both games, we find that when the probability of continuation δ increases, subjects with high cognitive ability more frequently employ cooperative, lenient, and forgiving strategies. However, we cannot find the same trend in low cognitive ability group. By comparing PG game and TPG game, we find that the effect of local benefit in impure public goods positively affects contribution among subjects with high cognitive ability when the probability of continuation is high, but not subjects with low cognitive ability.

Besides, I study whether algorithmic forecasters help investors make rational decisions in the financial market. Investors increasingly apply machine-learning approaches in financial market forecasting, e.g., stock price forecasting based on historical data. Although algorithms always outperform humans, we are still not clear whether investors trust the algorithmic forecasters and follow their advice in the financial market. Also, we study what personal characteristics (e.g., cognitive ability) affect investors’ trust in the algorithmic forecasters.

Fig 1. First period average contribution level (%) among treatments (δ=0.4 in T1, δ=0.8 in T2, δ=0.9 in T3) in high cognitive ability groups in infinitely repeated public goods game.

Fig 2. First period average contribution level (%) among treatments (δ=0.4 in T1, δ=0.8 in T2, δ=0.9 in T3) in low cognitive ability groups in infinitely repeated public goods game.

主要業績

- Kawamura, Tetsuya and Tse, Tiffany Tsz Kwan, “Intelligence promotes cooperation in long-term interaction: Experimental evidence in infinitely repeated public goods games", Journal of Economic Interaction & Coordination, May 2022.

- Kamei, Kenju, Kobayashi, Hajime, Tse, Tiffany Tsz Kwan, Observability of Partners’ Past Play and Cooperation: Experimental Evidence", Economic Letters, January 2022.

- Kawamura, Tetsuya and Tse, Tsz Kwan, “Shadow of the Future and Cooperative Strategies: Experimental Evidence from an Infinitely Repeated Transboundary Public Goods Game”, Keio Business Forum 37 (1), March 2020.